How Long Does Chapter 7 Bankruptcy Last Fundamentals Explained

Finding authorised for a conventional charge card could be tricky following bankruptcy, but Just about anyone can get authorized for the secured charge card. Such a card demands a cash deposit as collateral and tends to have small credit limits, but You can utilize a secured card to increase your credit rating rating given that your month to month payments might be described to your 3 credit rating bureaus — Experian, Equifax and TransUnion. Follow very good credit rating practices

Keep in mind that any missed payments or higher balances will show up with your cosigner's credit rating report as well as yours, so it is important to make each individual payment punctually and continue to keep balances small.

This chapter in the Bankruptcy Code gives for "liquidation" - the sale of a debtor's nonexempt residence and the distribution in the proceeds to creditors.

Checking account guideBest checking accountsBest free of charge checking accountsBest on-line Examine accountsChecking account alternate options

Bankrate follows a rigorous editorial policy, so that you can have faith in that we’re Placing your pursuits to start with. Our award-winning editors and reporters develop trustworthy and precise written content to help you make the proper economic conclusions. Essential Principles

Some company website debts typically can’t be erased in bankruptcy, such as latest taxes, little one guidance and university student financial loans. Bankruptcy continue to may be an selection this for you, though, if erasing other kinds of debt would free up enough money to pay for the debts which can’t be erased.

Personal savings account more helpful hints guideBest cost savings accountsBest large-yield savings accountsSavings accounts alternativesSavings calculator

We've got reviewed the do-it-your by yourself methods. basics Even so, the achievements of your Chapter 7 bankruptcy probably will lie in locating a highly trained bankruptcy lawyer.

Secured financial debt: Debt backed by property, for instance a property or car, which functions as collateral. Creditors of secured financial debt have the right to seize the collateral in case you default around the personal loan.

Which’s a major if. You need to move a method test, this means your disposable income is beneath the median cash flow in the state. Should you don’t qualify for Chapter 7, you may always fall back on Chapter 13.

For those who submitted for Chapter thirteen bankruptcy so as to reorganize your debts, You may even see some enhancement to the credit score score as you pay your balances down.

Put simply, your unlikely to shed things you possess Because You need article to file Chapter seven bankruptcy.

We manage a firewall amongst our advertisers and our editorial group. Our editorial team does not acquire direct payment from our advertisers. Editorial Independence

Secured debts: To take care of your secured debts, the property held as collateral could be purchased returned to the creditor.

Haley Joel Osment Then & Now!

Haley Joel Osment Then & Now! Dylan and Cole Sprouse Then & Now!

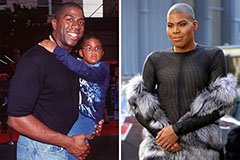

Dylan and Cole Sprouse Then & Now! Earvin Johnson III Then & Now!

Earvin Johnson III Then & Now! Monica Lewinsky Then & Now!

Monica Lewinsky Then & Now! Dolly Parton Then & Now!

Dolly Parton Then & Now!